Fixed Cost

Why Is The Total Variable Cost Important?

Otherwise, its total loss will be greater than the fixed costs. It will produce something only when the price covers average variable cost and part of the average fixed costs. The output at which marginal cost is equal to marginal revenue keeps losses minimum.

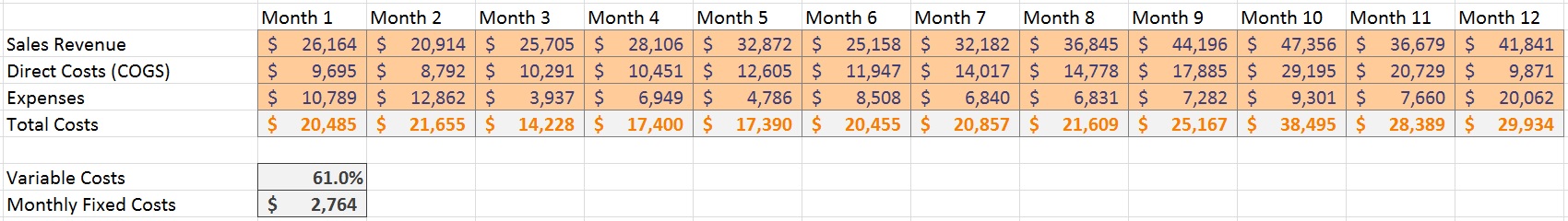

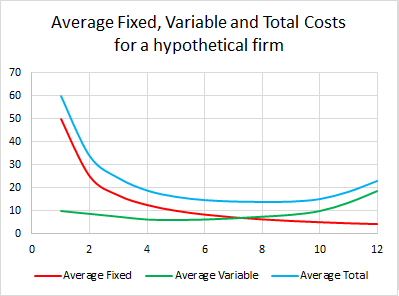

It means as the output increases Fixed costs remain the same, but variable costs increase at a diminishing rate then at constant rate and ultimately at an increasing rate. A company can increase its profits by decreasing its total costs. Since fixed costs are more challenging to bring down , most businesses seek to reduce their variable costs. Thus, decreasing costs usually means decreasing variable costs. While variable costs tend to remain flat, the impact of fixed costs on a company’s bottom line can change based on the number of products it produces.

The total variable cost is simply the quantity of output multiplied by the variable cost per unit of output. Unlike variable costs, a company’s Fixed costs do not vary with the volume of production. Fixed costs remain the same regardless of whether goods or services are produced or not. Fixed costs are costs that do not change when the quantity of output changes. Unlike variable costs, which change with the amount of output, fixed costs are not zero when production is zero.

How is variable cost calculated?

Variable costs are the sum of all labor and materials required to produce a unit of your product. Your total variable cost is equal to the variable cost per unit, multiplied by the number of units produced. Your average variable cost is equal to your total variable cost, divided by the number of units produced.

It is important to understand that variable costs, as opposed to fixed costs, are those costs that change based on the amount of product being produced. For example, our bottled water company has a variable cost in bottles. The more bottled water they produce, the higher their cost associated with bottles will be.

How Can I Calculate Break-even Analysis In Excel?

Are salaries a variable cost?

If a company bills out the time of its employees, and those employees are only paid if they work billable hours, then this is a variable cost. However, if they are paid salaries (where they are paid no matter how many hours they work), then this is a fixed cost.

For example, a consulting business has few Fixed costs, while most of its labor costs are variable. In addition to financial statement reporting, most companies will closely follow their cost structures through independent cost structure statements and dashboards. Many companies have cost analysts dedicated solely to monitoring and analyzing the fixed and variable costs of a business. Fixed costs are usually established by contract agreements or schedules.

Although Company XYZ’s total costs increase from $1,000,000 to $1,500,000, each widget becomes less expensive to produce and therefore more profitable. Economies of scale are another area of business that can only be understood within the framework of fixed and variable expenses. Economies of scale are possible because in most production operations the fixed costs are not related to production volume; variable costs are. Large production runs therefore « absorb » more of the fixed costs.

Example Of Average Total Cost (With Excel Template)

- For example, if a bicycle business had total fixed costs of $1,000 and only produced one bike, then the full $1,000 in fixed costs must be applied to that bike.

- On the other hand, if the same business produced 10 bikes, then the fixed costs per unit decline to $100.

- It is important to understand the behavior of the different types of expenses as production or sales volume increases.

- Total fixed costs remain unchanged as volume increases, while fixed costs per unit decline.

The price of a greater amount of goods can be spread over the same amount of a Fixed cost. In this way, a company may achieveeconomies of scale by increasing production and lowering costs. A company with a relatively large amount of variable costs may exhibit more predictable per-unit profit margins than a company with a relatively large amount of fixed costs.

Financial Statement Analysis

This revised production volume becomes the goal for the sales force. Conversely, if a company has low https://business-accounting.net/s, it probably has a high variable cost per unit. In this case, a business can earn a profit at very low volume levels, but does not earn outsized profits as sales increase.

Variable Costs Vs. Fixed Costs: An Overview

A small business owner can use a knowledge of fixed and variable expenses to determine the company’s break-even point , and in making decisions related to pricing goods and services. When business managers calculate their fixed costs per unit, it is important to look at all of the company’s expenses, not just general overhead costs. More than likely, the firm will have production-related costs that are fixed and should be included in the calculation. However, the goal of being in business is not just to reach the breakeven point each year but to make a profit.

Fixed Costs

These are base costs involved in operating a business comprehensively. Once established, fixed costs do not change over the life of an agreement or cost schedule. A company starting a new business would likely begin with fixed costs for rent and management salaries.

All types of businesses have https://business-accounting.net/fixed-cost/ agreements that they monitor regularly. While these fixed costs may change over time, the change is not related to production levels but rather new contractual agreements or schedules. Examples of fixed costs include rental lease payments, salaries, insurance, property taxes, interest expenses, depreciation, and potentially some utilities.

Iii. Marginal Cost:

This means that if a firm has a large amount of fixed costs, profit margins can really get squeezed when sales fall, which adds a level of risk to the stocks of these companies. Conversely, the same high-fixed-costs company will experience magnification of profits because any revenue increases are applied across a constant cost level. Thus, as you can see in the example, fixed costs are an important part of profit projections and the calculation of break-even points for a business or project. For example, let’s assume it costs Company XYZ $1,000,000 to produce 1,000,000 widgets per year ($1 per widget). This $1,000,000 cost includes $500,000 of administrative, insurance, and marketing expenses, which are generally fixed.