Are CFDs better than spread bets?

Example: selling a forex CFD

The Australian Exchange closed its CFD exchange in 2014, while in some countries, such as the United States or Belgium, CFD trading is outright banned. The European https://traderevolution.net/forex-maxitrade-opinions-advantages-of-working-with-maxitrade-broker/ financial regulator, ESMA also set up more stringent rules in the summer of 2018. Our spreads are the same for CFDs and spread betting, apart from shares.

While CFDs offer an attractive alternative to traditional markets, they also present potential pitfalls. For one, having to pay the spread on entries and exits eliminates the potential to profit from small moves. The spread also decreases winning trades by a small amount compared to the underlying security and will increase losses by a small amount. So, while traditional markets expose the trader to fees, regulations, commissions, and higher capital requirements, CFDs trim traders’ profits through spread costs.

How Long Can You Hold A Contract For Difference(CFD)?

CFDs started out as a type of leveraged equity swap in the 1990s in London, primarily used by hedge funds. In the late 1990s CFDs appeared on the retail market as well, while the 2000s and 2010s saw the first exchange traded and centrally cleared CFDs – https://traderevolution.net/ so things really picked up. The FCA estimated that the number of UK CFD brokers doubled between and UK clients held £3.5bn in their accounts in total. Because of the risks inherent in these contracts, regulators are increasingly strict with CFD brokers.

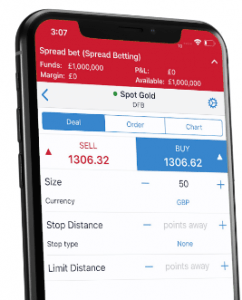

Share CFDs directly reflect the underlying market price, and are subject to commission. Share spread bets are commission free, but are subject to a spread on the opening and closing price of the bet.

Can you open an account?

CFDs are traded on margin meaning the broker allows investors to borrow money to increase leverage or the size of the position https://yandex.ru/search/?text=форекс%20обучение&lr=213 to amply gains. Brokers will require traders to maintain specific account balances before they allow this type of transaction.

You should consider whether you understand how CFDs, or any of our other products work, and whether you can https://ru.wikipedia.org/wiki/%D0%92%D0%B0%D0%BB%D1%8E%D1%82%D0%BD%D1%8B%D0%B9_%D1%80%D1%8B%D0%BD%D0%BE%D0%BA afford to take the high risk of losing your money. The value of your investments can go down as well as up.

- IG is one of the biggest and most reliable CFD brokers.

- If the share rises by 10%, then the position increases to 5,500 dollars.

- Please be aware that the leverage may be less depending both on the currency pair and on which of IG’s regulators your account is under.

- If you choose one of them, you can be sure you do not trade with a scam.

Spread betting vs CFDs

Are CFDs dangerous?

Best CFD Brokers That Are Not Scam All of these brokers offer CFD trading in addition to other forms of trading. These brokers are regulated buy a trusted authority, therefore they are considered to be very safe. eToro Disclaimer: 75% of retail CFD accounts lose money.

CFD providers on the other hand also levy a spread but charge a financing cost on top. In short a long CFD is in effect like borrowing https://search.yahoo.com/search;_ylt=A0geKYxcSeZdWYAAPZhXNyoA;_ylc=X1MDMjc2NjY3OQRfcgMyBGZyA3lmcC10BGZyMgNzYi10b3AEZ3ByaWQDBG5fcnNsdAMwBG5fc3VnZwMwBG9yaWdpbgNzZWFyY2gueWFob28uY29tBHBvcwMwBHBxc3RyAwRwcXN0cmwDMARxc3RybAMxOQRxdWVyeQNicmV4aXQlMjBrb25zZWt3ZW5jamUEdF9zdG1wAzE1NzUzNzMxNTg-?p=brexit+konsekwencje&fr2=sb-top&fr=yfp-t&fp=1 an asset in order to bet that it will rise in price. Your broker the lender will expect to earn money for lending you the asset.

Disadvantages of a CFD

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you How to Choose a Forex Broker understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd.

IG.com profile provided by IG Group, May 13, 2019

The big one is tax CFD profits are taxable whereas spread betting gains are not. That might seem like a big drawback but there’s a flipside losses on CFD trades attract tax relief whereas spread betting losses don’t. Then there are charges spread betting providers take their cut via the bid to offer spread.

However, the overall cost is virtually the same for share spread bets and share CFDs. CFD traders should remember we offer our tightest spreads on our standard contracts, with wider spreads on some mini and micro contracts. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider.

Should I spread bet or CFD?

Yes, CFDs on shares do pay dividends Just a like a stock, if you own a CFD you will receive a dividend if you own it the day before the ex-dividend date (more on that later). On the dividend payment date, an amount equivalent to the dividend for each share you have exposure to will be paid into your trading account.